Image source: Getty Images

Doing payroll for your small business doesn’t have to be hard: Employers in Canada can follow these seven simple steps to set up and run payroll.

Payroll can feel like a marathon: It doesn’t sound appealing to run, but once it’s over, you’re sweaty and happy you did.

Employers in Canada can follow these seven steps for a sweat-free payroll process.

1. Register with federal agencies

To run payroll in Canada, you need a Business Number (BN) and payroll program account through the Canada Revenue Agency (CRA). A BN identifies your business to the federal government. It’s the business version of a Social Insurance Number (SIN).

A payroll program account is a 15-digit number that contains your nine-digit BN. It’s your business’s unique identifier to the CRA. New businesses can register for a BN and payroll program account simultaneously on the CRA website.

The registration process requires the following information:

- Pay schedule, whether it’s weekly, bi-weekly, or semi-monthly

- Number of employees

- Payroll software or service you intend to use

You may also need to set up accounts with the Ontario Workplace and Safety Board and the Ontario Ministry of Finance to remit workplace insurance and health tax payments.

2. Gather employee information

Next, collect the following information from your employees:

- Name

- Address

- Phone number

- Social Insurance Number (SIN)

- Date of birth

- Bank account information for direct deposit

Employees must submit federal and provincial TD1 forms. The information they provide determines some payroll deductions. You can download TD1 forms on the CRA website.

Enter this information into your payroll software. Employers who do payroll manually should create a secure records management system to store sensitive employee information.

2. Calculate gross wages

Gross wages are an employee’s earnings before payroll deductions, such as taxes and retirement contributions. An employee’s gross wages are the amount you put on his or her offer letter. Gross wages can be expressed per hour, pay period, or year.

Include taxable fringe benefits in the gross wages calculation. If you reimburse your employees for their cell phone or parking costs, add those benefits to gross wages. Check the CRA website for the taxability of benefits and allowances.

Hourly employees who work over 40 hours in a workweek or over eight hours in a day might be subject to time and a half overtime pay.

Consider Olivia, who works at a flower shop in British Columbia. She makes CA$60,000 per year and is paid twice monthly. Her annual gross salary is CA$60,000. She doesn’t receive any fringe benefits. She also brings a fantastic bouquet whenever she’s invited to a dinner party.

Olivia’s gross wages for the pay period are CA$2,500 (CA$60,000 / 24 pay periods per year).

3. Calculate and deduct taxes and contributions

Both employees and employers buck up for Canadian payroll taxes and contributions.

As an employer, you’re responsible for withholding and remitting a portion of employees’ wages for taxes and contributions. CRA payroll deductions include:

- Federal income tax

- Provincial or territorial income tax

- Canada Pension Program (CPP) or Quebec Pension Program (QPP) contributions

- Employment Insurance (EI) premiums

- Registered Retirement Savings Plan (RRSP) contributions

All but RRSP are required CRA deductions. CPP/QPP contributions apply to employees ages 18 to 69, and EI premiums apply to employees of all ages.

Both employees and employers pay into CPP/QPP and EI, based on employee earnings. Contributions stop once they’ve reached their annual maximum. All provinces but Quebec follow the same contribution rates and limits.

2020 CPP/QPP limits are:

|

Rate of eligible wages |

Annual employee limit |

Annual employer limit |

|

|---|---|---|---|

|

Federal (CPP) |

5.25% |

CA$2,898 |

CA$2,898 |

|

Quebec (QPP) |

5.7% |

CA$3,146.40 |

CA$3,146.40 |

2020 EI limits are:

|

Employee rate of eligible wages |

Employer rate of eligible wages |

Annual employee limit |

Annual employer limit |

|

|---|---|---|---|---|

|

Federal |

1.58% |

2.21% |

CA$856.36 |

CA$1,198.90 |

|

Quebec |

1.2% |

1.68% |

CA$650.40 |

CA$910.56 |

In some provinces, employers with annual payroll expenses around CA$500,000 or more pay the Employer Health Tax (EHT), which helps fund the country’s universal healthcare system. Employees don’t contribute to EHT.

Your payroll software automatically calculates tax and contribution amounts according to tax law, your employees’ Forms TD1, and other information you enter.

Business owners who do their own payroll can use the CRA Payroll Deduction Calculator to calculate their employee paychecks.

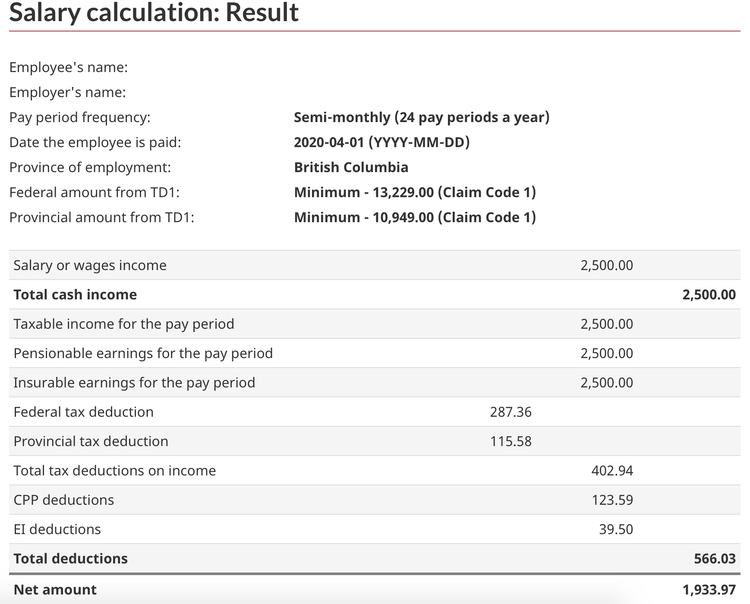

I calculated Olivia’s paycheck dated April 1, 2020 using the CRA online tool.

Use the CRA Payroll Deduction Calculator to determine employee withholding. Image source: Author

Olivia’s paycheck is CA$1,933.97.

5. Reconcile and issue paychecks

Let’s get your employees paid.

Before you finish processing payroll, complete a payroll reconciliation to check for errors. Compare your payroll register — a list of payroll transactions — to your tax records and general ledger.

Once you clear up any errors, you’re ready to send out employee paychecks through your payroll software. Most payroll software packages offer portals where employees can see their pay stub.

Employers doing payroll manually should still provide a pay stub for employees to prove income when applying for loans and leases, get a status update on accrued vacation and sick time, and catch payroll errors.

Finally, record a payroll journal entry in your accounting software. You can integrate your payroll and accounting software to complete this step.

6. Remit deductions and taxes to the CRA

Now it’s time to send the deductions and employer taxes calculated in step four where they need to go. By default, businesses must remit payroll deductions by paper or electronically by the 15th of the month following the pay period.

But if that pay schedule doesn’t work for you, you’ve got options — honestly, more than you need. Established businesses can change to a quarterly, twice-monthly, or four-times-monthly payroll tax remittance cadence.

Send federal taxes, provincial taxes, CPP deductions, and EI deductions to the CRA. Send QPP deductions to Quebec’s revenue agency, Revenu Quebec.

7. Generate and share Forms T4

By the last day in February of the following year, you must share a Form T4 with each employee and the CRA. Form T4 summarizes the employees’ earnings and deductions from the previous calendar year.

In the packet of Forms T4 submitted to the CRA, you must include a summary form that sums all employee earnings and deductions.

Get some (payroll) help

If you made it to the end and you didn’t shed a tear at step four, kudos.

While it’s important to know how payroll works, you can feel comfortable letting payroll software take care of payroll tax and contribution calculations. When set up correctly, payroll software reduces errors (read: headaches) and increases efficiency.